Animal Nutrition Market

Animal Nutrition Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_701635 | Last Updated : July 30, 2025 |

Format : ![]()

![]()

![]()

![]()

Animal Nutrition Market Size

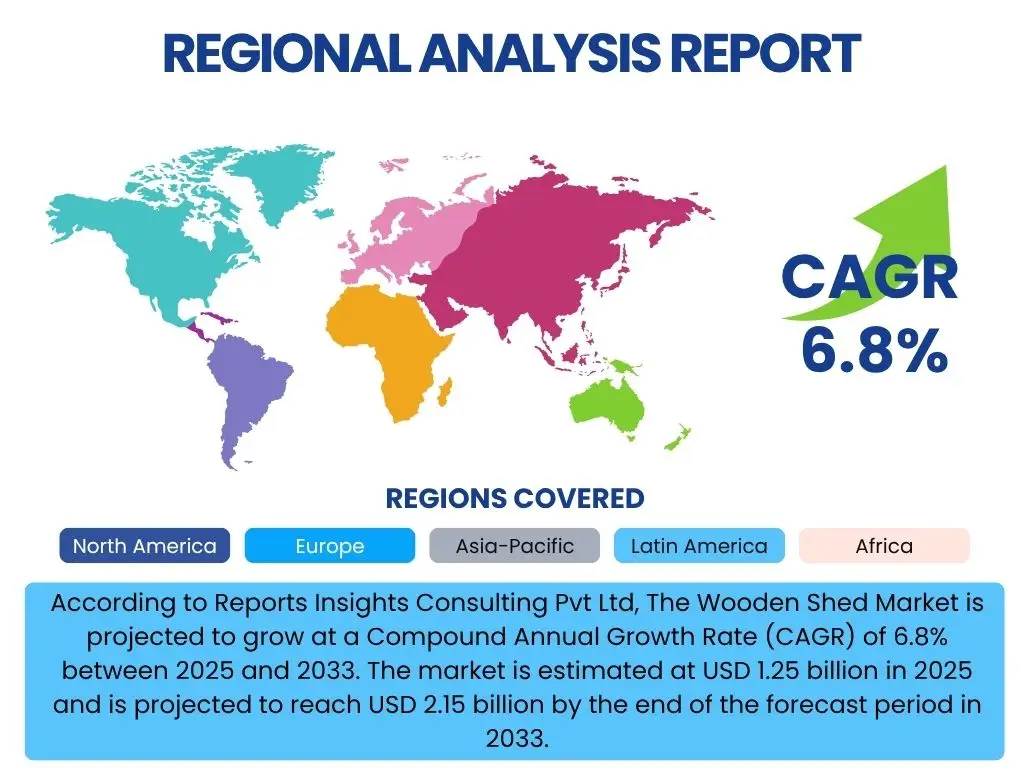

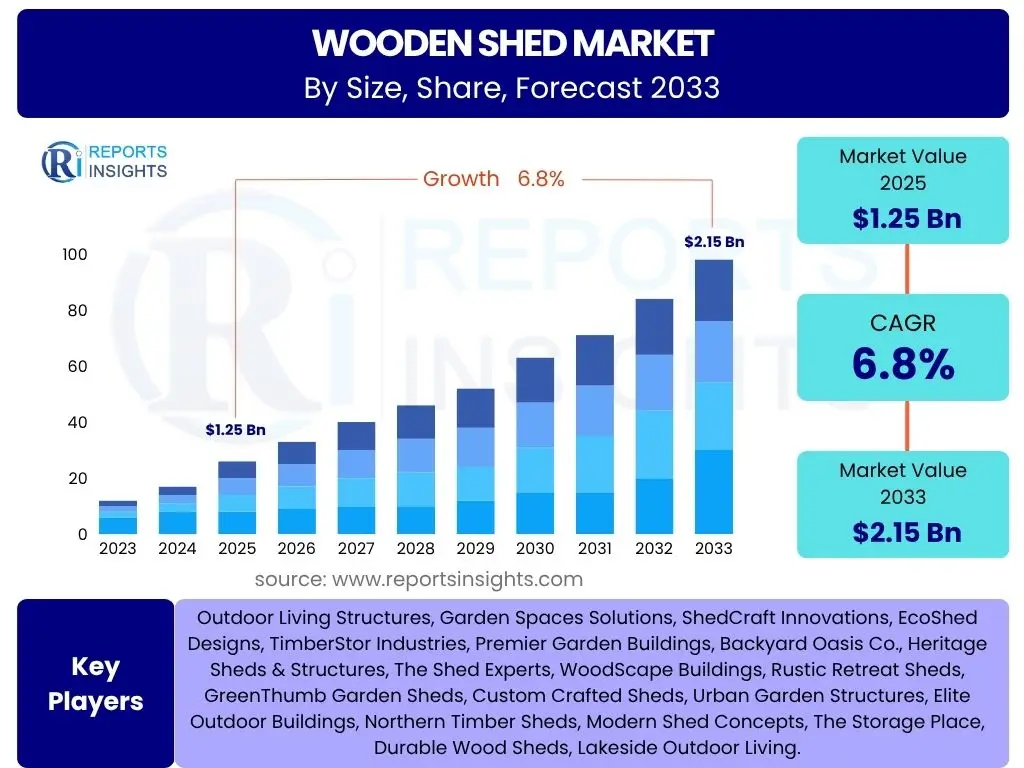

According to Reports Insights Consulting Pvt Ltd, The Animal Nutrition Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.78% between 2025 and 2033. The market is estimated at USD 25.05 Billion in 2025 and is projected to reach USD 42.15 Billion by the end of the forecast period in 2033.

Key Animal Nutrition Market Trends & Insights

The animal nutrition market is currently undergoing a significant transformation driven by evolving global dietary patterns and an increased focus on animal health and sustainable agricultural practices. Consumer awareness regarding the quality and safety of animal products, coupled with a growing demand for protein, is compelling the industry to innovate. There is a strong emphasis on developing highly efficient, specialized, and environmentally friendly feed solutions that not only enhance animal productivity but also support overall animal welfare and reduce the ecological footprint of livestock farming.

Furthermore, advancements in nutritional science and biotechnology are enabling the creation of novel feed additives that address specific physiological needs of animals, improve nutrient absorption, and bolster immune systems. The integration of digital technologies and data analytics in farm management is also emerging as a pivotal trend, allowing for precision feeding strategies and real-time health monitoring. This shift towards data-driven and tailored nutritional approaches is critical for optimizing resource utilization and ensuring sustainable growth within the animal agriculture sector globally.

- Precision Nutrition and Personalized Feeding: Utilizing data and technology to tailor nutrient delivery to individual animals or specific groups based on genetics, age, health status, and production goals.

- Focus on Gut Health and Microbiome Modulation: Increasing development and adoption of prebiotics, probiotics, and postbiotics to enhance digestive health, nutrient absorption, and immunity, reducing reliance on antibiotics.

- Sustainable and Environmentally Friendly Feed Solutions: Growing demand for ingredients and practices that minimize environmental impact, including alternative protein sources, reduced methane emissions from ruminants, and improved feed conversion ratios.

- Digitalization and Farm Automation: Integration of IoT, AI, and Big Data for real-time monitoring of animal behavior, health, feed intake, and environmental conditions, leading to optimized farm management.

- Increased Demand for Functional Feed Additives: Development and use of specialized additives that offer specific health benefits beyond basic nutrition, such as immune boosters, anti-stress agents, and natural growth promoters.

- Traceability and Transparency in the Supply Chain: Heightened consumer and regulatory pressure for clear origins of feed ingredients and animal products, driving adoption of blockchain and other tracking technologies.

AI Impact Analysis on Animal Nutrition

Artificial Intelligence (AI) is rapidly revolutionizing the animal nutrition sector by enabling unprecedented levels of precision, efficiency, and predictive capabilities. AI algorithms can analyze vast datasets, including genetic information, feed composition, environmental factors, and animal health metrics, to formulate optimal diets that maximize growth, improve feed conversion, and reduce waste. This data-driven approach allows nutritionists to create highly customized feed plans that are dynamically adjusted based on real-time animal performance and health status, leading to significant economic benefits for producers and improved welfare for animals.

Moreover, AI plays a crucial role in enhancing disease surveillance and early detection within livestock populations. AI-powered monitoring systems, leveraging computer vision and sensor technologies, can identify subtle changes in animal behavior or physical condition that may indicate the onset of illness, prompting timely intervention and limiting the spread of diseases. This proactive approach not only safeguards animal health but also contributes to food safety and reduces the need for extensive medical treatments. The integration of AI extends to supply chain management, optimizing logistics, ensuring ingredient quality, and enhancing the overall traceability of animal nutrition products from farm to fork.

- Precision Feed Formulation: AI optimizes nutrient ratios in feed by analyzing complex variables such as animal genetics, physiological state, and environmental conditions, leading to customized and efficient diets.

- Predictive Health Management: AI algorithms analyze data from sensors and cameras to detect early signs of disease or stress in livestock, enabling proactive interventions and reducing medication use.

- Automated Livestock Monitoring: AI-powered systems track animal behavior, growth rates, and feed intake in real-time, providing actionable insights for farm management and improving productivity.

- Optimized Resource Utilization: AI helps minimize feed waste and improve feed conversion ratios, contributing to more sustainable and cost-effective animal production.

- Supply Chain Optimization and Traceability: AI enhances the transparency and efficiency of the animal nutrition supply chain, from sourcing raw materials to product distribution, ensuring quality and safety.

Key Takeaways Animal Nutrition Market Size & Forecast

The animal nutrition market is poised for robust and sustained growth through the forecast period, driven primarily by the escalating global demand for animal protein, particularly in emerging economies. This consistent demand underpins the market's resilience and its strategic importance to global food security. The industry's expansion is further propelled by continuous innovation in feed additives and nutritional solutions, which are critical for enhancing animal productivity, improving health outcomes, and mitigating environmental impacts associated with livestock farming.

A significant takeaway is the increasing emphasis on sustainable and precision-oriented approaches, reflecting a broader industry shift towards efficiency, animal welfare, and responsible resource management. Technological integration, especially artificial intelligence and data analytics, will be a key differentiator, enabling more sophisticated and tailored nutritional strategies. Stakeholders capable of adapting to stringent regulatory environments, embracing technological advancements, and meeting the evolving consumer expectations for transparent and ethically produced animal products are best positioned to capitalize on the market's growth potential.

- Market Resilience: The animal nutrition market demonstrates strong resilience and consistent growth, fueled by unwavering global demand for animal protein and increasing consumer focus on food safety and quality.

- Innovation as a Growth Engine: Continuous research and development in feed additives, functional ingredients, and sustainable nutritional solutions are critical drivers expanding market opportunities and enhancing animal performance.

- Technological Integration: Adoption of advanced technologies such as AI, IoT, and data analytics for precision nutrition, farm management, and disease prevention is transforming the industry landscape and driving efficiency.

- Sustainability Imperative: Growing focus on environmentally friendly feed practices, reduction of antimicrobial resistance, and optimization of resource utilization are becoming central to market strategy and product development.

- Emerging Market Dominance: The Asia Pacific region, driven by rapid urbanization and rising incomes, is set to be the primary growth engine, offering significant opportunities for market expansion and investment.

Animal Nutrition Market Drivers Analysis

The animal nutrition market is significantly propelled by several key factors that underscore its fundamental importance to global food security and efficient animal production. A primary driver is the relentless increase in global population coupled with rising disposable incomes in developing regions, which fuels a consistent demand for animal-derived protein such as meat, dairy, and eggs. This expanding consumer base necessitates more efficient and productive livestock farming, creating a direct demand for advanced animal nutrition solutions. Furthermore, a growing global awareness regarding animal health, welfare, and the safety of animal products is driving the adoption of high-quality, specialized feed ingredients and additives. This focus extends to preventive health measures, reducing reliance on antibiotics, and enhancing the overall well-being of livestock. The intensification of livestock farming practices worldwide, aimed at meeting the soaring demand with limited resources, further solidifies the need for nutritionally optimized feeds that maximize output and minimize resource consumption.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increasing Global Population & Demand for Animal Protein | +1.8% | Global, particularly Asia Pacific & Latin America | Long-term (2025-2033) |

| Rising Awareness of Animal Health & Welfare | +1.5% | North America, Europe, Developed Asia Pacific | Medium-term (2025-2030) |

| Technological Advancements in Feed Formulation & Additives | +1.2% | Global | Medium-term (2025-2030) |

| Intensification of Livestock Farming Practices | +1.0% | Developing Regions (APAC, LatAm, MEA) | Long-term (2025-2033) |

| Growing Pet Ownership & Humanization of Pets | +0.8% | North America, Europe, Developed Asia Pacific | Long-term (2025-2033) |

Animal Nutrition Market Restraints Analysis

Despite its significant growth potential, the animal nutrition market faces several restraints that could impede its expansion. One prominent challenge is the volatility and rising cost of raw materials, such as grains, oilseeds, and protein meals. These price fluctuations, often influenced by geopolitical events, climate change, and global supply chain disruptions, directly impact production costs for animal feed manufacturers, which can then be passed on to livestock producers, potentially dampening demand or profitability. Furthermore, stringent regulatory frameworks and evolving standards, particularly in developed regions, concerning feed safety, additive use, and environmental emissions, necessitate significant compliance investments and can limit the introduction of new products. The growing consumer shift towards plant-based and alternative protein diets, primarily in developed Western markets, also poses a long-term restraint, as it could temper the demand for traditionally sourced animal products, thereby indirectly affecting the animal nutrition sector. Lastly, the recurring threat of animal disease outbreaks, such as African Swine Fever or Avian Influenza, can lead to mass culling of livestock, severely disrupting regional markets and causing substantial economic losses across the value chain.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Raw Material Prices & Supply Chain Disruptions | -1.5% | Global | Short to Medium-term (2025-2028) |

| Stringent Regulatory Frameworks & Approval Processes | -1.0% | Europe, North America | Medium-term (2025-2030) |

| Disease Outbreaks in Livestock | -0.8% | Regional/Country Specific | Short to Medium-term (2025-2028) |

| Growing Consumer Preference for Plant-Based Diets | -0.5% | North America, Europe | Long-term (2028-2033) |

Animal Nutrition Market Opportunities Analysis

The animal nutrition market is replete with significant opportunities driven by evolving consumer preferences, technological advancements, and the burgeoning demand from emerging economies. A key opportunity lies in the continuous development and commercialization of novel feed additives, including functional ingredients that enhance nutrient utilization, improve animal health, and reduce environmental impact. These innovations cater to the industry's need for solutions that support sustainable and efficient animal production while addressing concerns related to antimicrobial resistance. Furthermore, the increasing global focus on sustainability and environmental stewardship presents a lucrative avenue for animal nutrition companies to invest in eco-friendly feed solutions, such as those that reduce methane emissions in ruminants or improve nutrient digestibility to lower manure output. The rapid expansion of livestock and aquaculture industries in developing regions, particularly in Asia Pacific and Latin America, also offers substantial market penetration and growth prospects for companies seeking to broaden their geographical footprint. Moreover, the humanization trend in pet ownership fuels a robust demand for premium and specialized pet nutrition products, mirroring human dietary trends like organic, natural, and functional foods, creating a high-value segment within the market.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Development & Adoption of Novel Feed Additives (Probiotics, Enzymes) | +1.5% | Global | Long-term (2025-2033) |

| Increasing Focus on Sustainable & Eco-friendly Animal Production | +1.2% | Global, particularly Europe & North America | Long-term (2025-2033) |

| Expansion into Emerging Markets (Asia Pacific, Latin America) | +1.0% | Asia Pacific, Latin America, Middle East & Africa | Long-term (2025-2033) |

| Growing Demand for Functional & Premium Pet Nutrition | +0.8% | North America, Europe, Developed Asia Pacific | Long-term (2025-2033) |

Animal Nutrition Market Challenges Impact Analysis

The animal nutrition market faces several significant challenges that could affect its growth trajectory and operational efficiency. One of the primary hurdles is the increasing global concern regarding antimicrobial resistance (AMR), which pressures the industry to reduce or eliminate the use of antibiotics as growth promoters. This necessitates substantial research and development into alternative solutions, such as probiotics, prebiotics, and phytogenics, which comes with considerable investment and regulatory complexities. Another challenge stems from the lack of standardized regulations across different regions and countries, creating barriers to market entry and complicating international trade. Companies must navigate diverse and often conflicting legal frameworks concerning feed ingredients, labeling, and safety standards, which can increase operational costs and slow product innovation. Furthermore, the intense competition within a fragmented market, characterized by numerous local and international players, leads to price pressures and demands continuous product differentiation. Finally, consumer perception and acceptance of certain feed additives or farming practices, particularly regarding genetically modified ingredients or intensive farming methods, present a reputational challenge that requires transparent communication and adherence to ethical standards to maintain trust and market acceptance.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Concerns Regarding Antimicrobial Resistance (AMR) | -1.3% | Global, particularly Europe & North America | Long-term (2025-2033) |

| Lack of Standardized Regulatory Frameworks Globally | -1.0% | Global | Medium-term (2025-2030) |

| Intense Competition & Market Fragmentation | -0.7% | Global | Medium-term (2025-2030) |

| Consumer Perception & Acceptance of Certain Ingredients | -0.5% | Developed Regions | Long-term (2028-2033) |

Animal Nutrition Market - Updated Report Scope

The comprehensive scope of this market research report delves deep into the multifaceted landscape of the global Animal Nutrition Market. It provides an exhaustive analysis of market size estimations, historical trends from 2019 to 2023, and meticulous forecasts extending to 2033, enabling stakeholders to gauge future growth trajectories and investment opportunities. The report meticulously segments the market across various dimensions, including animal type, product type, form, and sales channels, offering granular insights into specific sub-markets. Furthermore, it incorporates an in-depth assessment of the competitive landscape, profiling leading market participants and their strategic initiatives, alongside a thorough regional analysis spanning major continents, to provide a holistic understanding of the market's dynamics and potential.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 25.05 Billion |

| Market Forecast in 2033 | USD 42.15 Billion |

| Growth Rate | 6.78% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Archer Daniels Midland Company (ADM), Evonik Industries AG, DSM-Firmenich, Nutreco N.V., Alltech Inc., ForFarmers N.V., Phibro Animal Health Corporation, Kemin Industries, Zinpro Corporation, Novus International Inc., Biomin (Erber Group), Bluestar Adisseo Co. Ltd., Charoen Pokphand Foods Public Company Limited (CPF), De Heus Animal Nutrition, Jefo Nutrition Inc., Lallemand Inc., BASF SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The global animal nutrition market is extensively segmented to provide granular insights into its diverse components and dynamics. This segmentation facilitates a comprehensive understanding of specific market niches, consumer preferences, and technological adoptions across various animal types and product categories. Analyzing these segments helps stakeholders identify high-growth areas, develop targeted strategies, and tailor product offerings to meet the specific nutritional requirements and production goals pertinent to different livestock and pet industries. This detailed breakdown ensures that the report captures the full complexity of the market, from staple feed ingredients to advanced, functional additives.

Key segmentation categories include animal type, which distinguishes between poultry, swine, ruminants, aquaculture, and pets, reflecting the unique dietary needs and market sizes of each group and their contribution to overall market revenue. Product type further dissects the market into feed additives, encompassing vital components like vitamins, amino acids, enzymes, and prebiotics that enhance performance and health, and primary feed ingredients such as protein and fat sources essential for growth. The market is also segmented by product form (dry and liquid) and sales channel (direct sales, distributors, and online platforms), illustrating the varied distribution and consumption patterns influencing market accessibility and reach. This multi-dimensional segmentation is critical for a nuanced assessment of market trends, competitive positioning, and future investment opportunities across the entire value chain.

- By Animal Type

- Poultry

- Swine

- Ruminants

- Aquaculture

- Pets

- Others

- By Product Type

- Feed Additives

- Vitamins

- Amino Acids

- Enzymes

- Antioxidants

- Mycotoxin Binders

- Prebiotics & Probiotics

- Minerals

- Others

- Feed Protein

- Soybean Meal

- Fish Meal

- Others

- Feed Fat

- Animal Fat

- Vegetable Oil

- Others

- Others

- Feed Additives

- By Form

- Dry

- Liquid

- By Sales Channel

- Direct Sales

- Distributors

- Online

Regional Highlights

Geographical analysis is paramount in understanding the varied growth drivers, regulatory landscapes, and consumption patterns across the global animal nutrition market. Each region presents a unique set of opportunities and challenges, influenced by factors such as population density, dietary habits, agricultural practices, and economic development. This section provides a detailed overview of the market performance and future potential across major continents, highlighting the specific dynamics that shape their respective animal nutrition industries and contribute to the overall market trajectory.

North America and Europe, as mature markets, are characterized by stringent regulations, a strong focus on animal welfare, and significant adoption of advanced feed technologies and specialized additives, particularly for pet nutrition and premium livestock farming. Innovation in sustainable practices and reduction of antimicrobial use are key drivers in these regions. Asia Pacific, conversely, represents the largest and fastest-growing market, propelled by rapidly increasing demand for animal protein due to population growth and rising disposable incomes, expanding aquaculture industries, and the modernization of farming practices in countries like China, India, and Southeast Asian nations. Latin America shows robust potential driven by its substantial beef and poultry production for both domestic consumption and export, leading to a rising demand for efficient feed solutions. The Middle East and Africa are emerging markets with growing investments in food security, leading to increasing adoption of modern agricultural techniques and commercial livestock farming, albeit from a lower base.

- North America: Characterized by high adoption of precision nutrition, significant R&D in feed additives, and a strong emphasis on pet nutrition and animal welfare. The market is mature but continually innovating.

- Europe: Driven by stringent regulations regarding feed safety, environmental sustainability, and antimicrobial reduction, fostering innovation in alternative feed solutions and eco-friendly practices.

- Asia Pacific (APAC): The largest and fastest-growing region, fueled by increasing demand for meat, dairy, and aquaculture products due to population growth and urbanization in China, India, and Southeast Asian countries.

- Latin America: Exhibits significant growth potential, particularly in Brazil and Argentina, owing to their large-scale beef, poultry, and pork production for global export and domestic consumption.

- Middle East and Africa (MEA): An emerging market with increasing investments in modern livestock farming and aquaculture to enhance food security, leading to a rising demand for quality animal nutrition products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Nutrition Market.- Cargill

- Archer Daniels Midland Company (ADM)

- Evonik Industries AG

- DSM-Firmenich

- Nutreco N.V.

- Alltech Inc.

- ForFarmers N.V.

- Phibro Animal Health Corporation

- Kemin Industries

- Zinpro Corporation

- Novus International Inc.

- Biomin (Erber Group)

- Bluestar Adisseo Co. Ltd.

- Charoen Pokphand Foods Public Company Limited (CPF)

- De Heus Animal Nutrition

- Jefo Nutrition Inc.

- Lallemand Inc.

- BASF SE

Frequently Asked Questions

What is animal nutrition?

Animal nutrition encompasses the study of the dietary needs of animals, focusing on the composition of feed ingredients and their impact on animal health, growth, productivity, and welfare. It involves formulating balanced diets using various raw materials, supplements, and additives to optimize nutrient intake for different animal types, aiming to improve feed conversion, disease resistance, and overall performance in livestock, poultry, aquaculture, and pets.

What factors are driving the growth of the animal nutrition market?

The animal nutrition market's growth is primarily driven by the increasing global demand for animal protein, rising awareness of animal health and welfare, technological advancements in feed formulation, and the intensification of livestock farming practices worldwide. Additionally, the growing humanization of pets and the demand for specialized pet nutrition contribute significantly to market expansion.

What are the key trends shaping the animal nutrition industry?

Key trends include the adoption of precision nutrition tailored to individual animal needs, a strong emphasis on gut health through prebiotics and probiotics, the development of sustainable and environmentally friendly feed solutions, and the increasing integration of digitalization and farm automation technologies for efficient management. There is also a growing demand for functional feed additives and enhanced supply chain traceability.

How is AI impacting the animal nutrition sector?

Artificial Intelligence is transforming animal nutrition by enabling highly precise feed formulation, predictive health management through early disease detection, and automated livestock monitoring. AI algorithms analyze vast datasets to optimize nutrient delivery, improve resource utilization, and enhance overall farm efficiency and animal welfare, driving a new era of data-driven decision-making in the industry.

What are the major challenges in the animal nutrition market?

The primary challenges include volatile raw material prices, stringent and non-uniform regulatory frameworks across regions, concerns regarding antimicrobial resistance which necessitates innovation in alternative solutions, intense competition within a fragmented market, and evolving consumer perceptions about certain feed ingredients or farming practices, requiring greater transparency and ethical considerations.