Aircraft ACMI Leasing Market

Aircraft ACMI Leasing Market Size, Scope, Growth, Trends and By Segmentation Types, Applications, Regional Analysis and Industry Forecast (2025-2033)

Report ID : RI_702187 | Last Updated : July 31, 2025 |

Format : ![]()

![]()

![]()

![]()

Aircraft ACMI Leasing Market Size

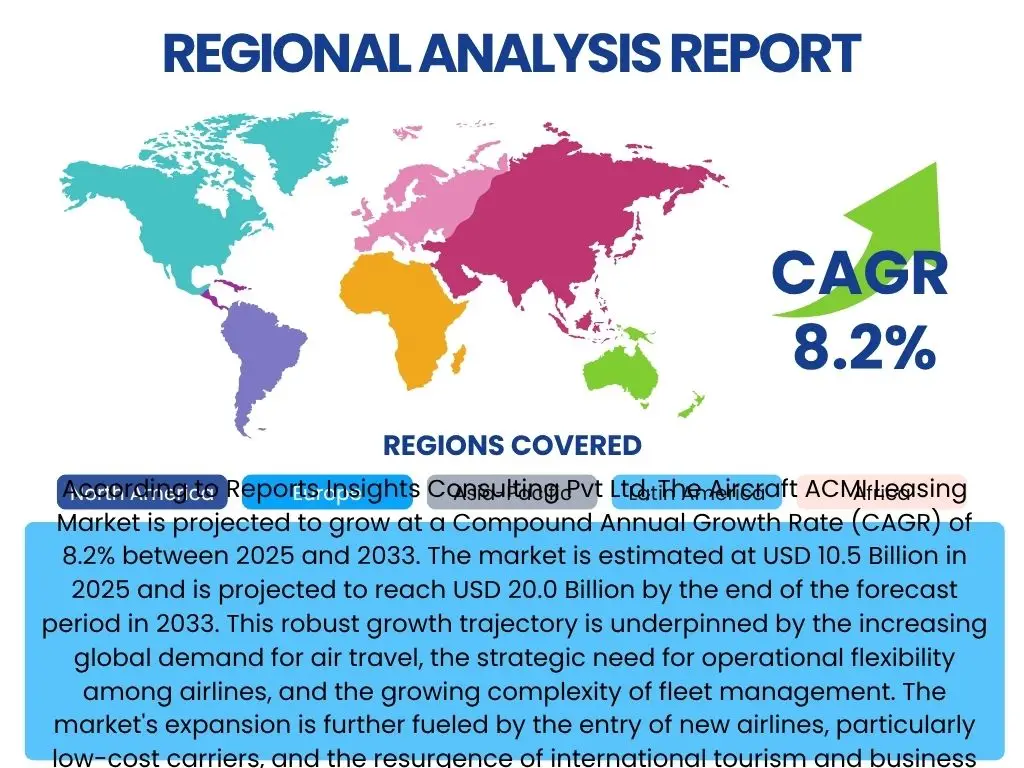

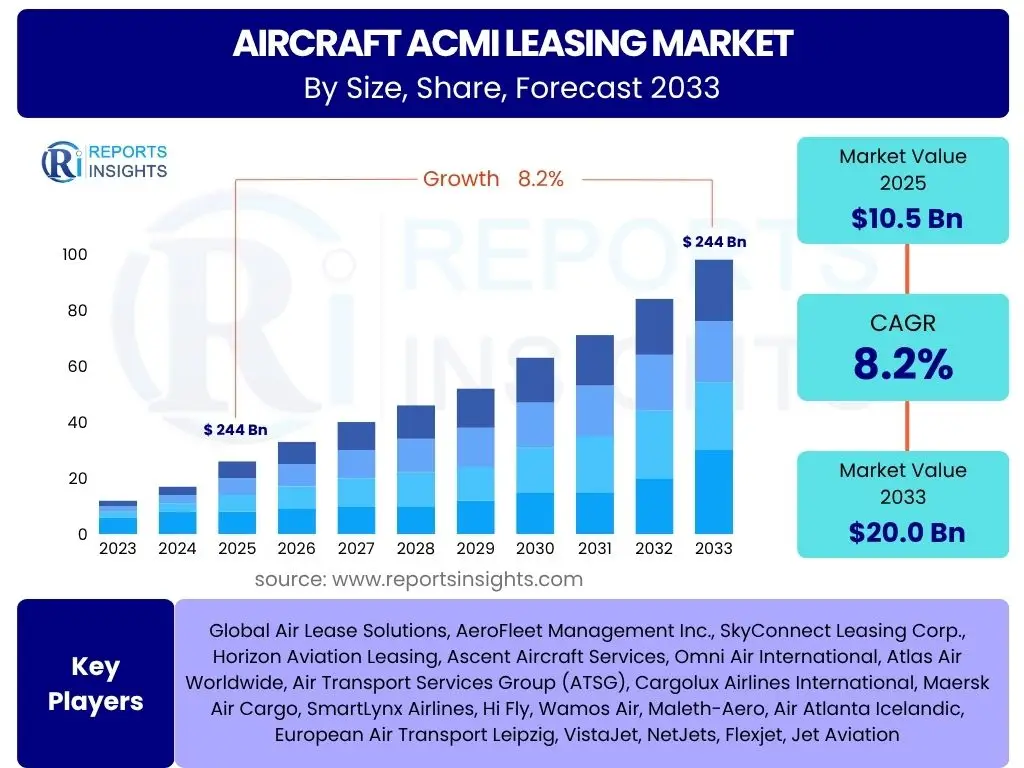

According to Reports Insights Consulting Pvt Ltd, The Aircraft ACMI Leasing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2025 and 2033. The market is estimated at USD 10.5 Billion in 2025 and is projected to reach USD 20.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by the increasing global demand for air travel, the strategic need for operational flexibility among airlines, and the growing complexity of fleet management. The market's expansion is further fueled by the entry of new airlines, particularly low-cost carriers, and the resurgence of international tourism and business travel.

The ACMI (Aircraft, Crew, Maintenance, and Insurance) leasing model offers a compelling solution for airlines seeking to optimize their fleet capacity without incurring the substantial capital expenditure associated with aircraft acquisition. This approach allows carriers to rapidly adjust to fluctuating demand, manage seasonal peaks, and bridge operational gaps, thereby enhancing their agility in a dynamic aviation landscape. The market forecast highlights a sustained upward trend, reflecting the indispensable role ACMI leasing plays in modern airline operations and strategic planning.

Key Aircraft ACMI Leasing Market Trends & Insights

Common user questions regarding Aircraft ACMI Leasing trends often revolve around the drivers of market growth, the impact of global events, and the emergence of new operational models. Users frequently inquire about the longevity of the post-pandemic recovery, the influence of sustainability mandates, and how technological advancements are reshaping leasing agreements. There is significant interest in understanding how airlines are balancing cost efficiency with operational resilience in an increasingly volatile environment. Furthermore, queries often touch upon regional market disparities and the specific demands from different airline segments, such as cargo carriers versus passenger airlines.

The Aircraft ACMI Leasing market is experiencing a significant transformation driven by several key factors. The post-pandemic rebound in air travel has revitalized demand, pushing airlines to seek flexible capacity solutions to meet surging passenger and cargo volumes. This resurgence is not uniform, with certain regions and aircraft types demonstrating more rapid recovery and growth. Airlines are increasingly utilizing ACMI leases to manage fleet shortages, test new routes, and mitigate the risks associated with long-term asset ownership, thereby enhancing their operational agility and financial prudence. This strategic shift is contributing to a more resilient and adaptable aviation ecosystem, where immediate capacity needs can be addressed without significant capital commitment.

Another prominent trend is the growing emphasis on sustainability and operational efficiency within leasing agreements. Lessees are increasingly prioritizing aircraft that are fuel-efficient and comply with evolving environmental regulations, prompting lessors to invest in newer generation fleets. Furthermore, the diversification of ACMI applications beyond traditional passenger services, such as dedicated cargo operations and specialized missions, is expanding the market's scope. The integration of advanced digital solutions for fleet management, predictive maintenance, and operational analytics is also becoming a standard expectation, improving the overall value proposition of ACMI services and enabling more streamlined operations for both lessors and lessees. This technological integration is crucial for optimizing resource utilization and enhancing safety standards across the leased fleet.

- Post-Pandemic Demand Surge: Rapid increase in air travel and cargo demand necessitating immediate capacity solutions.

- Fleet Modernization Focus: Growing preference for new-generation, fuel-efficient aircraft to meet environmental targets and reduce operational costs.

- Diversification of Lease Applications: Expansion of ACMI use beyond passenger transport to include dedicated cargo, charter, and special mission operations.

- Emphasis on Operational Flexibility: Airlines prioritizing short-term and flexible leasing options to adapt to dynamic market conditions and manage seasonal fluctuations.

- Digital Transformation in Leasing: Adoption of advanced analytics, IoT, and AI for improved fleet tracking, maintenance scheduling, and contract management.

AI Impact Analysis on Aircraft ACMI Leasing

Common user questions related to the impact of AI on Aircraft ACMI Leasing frequently focus on how artificial intelligence can optimize operational aspects, reduce costs, and enhance decision-making processes. Users are keen to understand the practical applications of AI in areas like predictive maintenance, fuel efficiency, route optimization, and dynamic pricing strategies for leasing contracts. Concerns are also raised regarding the data privacy and security implications of AI adoption, as well as the potential for job displacement and the need for new skill sets within the industry. There is a clear desire for insights into how AI can foster greater transparency and efficiency in lease management and aircraft utilization.

The integration of Artificial Intelligence (AI) is set to significantly revolutionize the Aircraft ACMI Leasing market by enhancing operational efficiency and strategic decision-making. AI-powered analytics can process vast amounts of flight data, maintenance logs, and market trends to provide predictive insights. This capability allows lessors to anticipate maintenance needs, optimize aircraft deployment schedules, and dynamically price leases based on real-time supply and demand fluctuations. For airlines, AI facilitates more accurate fleet planning, identifies opportunities for fuel savings through optimized flight paths, and improves crew scheduling, thereby reducing operational overheads and increasing profitability. The ability of AI to identify patterns and anomalies quickly is critical for maximizing aircraft utilization and minimizing downtime.

Furthermore, AI can streamline the complex processes involved in lease agreements, from automated contract generation and compliance checks to performance monitoring and risk assessment. Machine learning algorithms can analyze historical lease performance data to identify potential risks, such as payment defaults or operational inefficiencies, enabling lessors to make more informed decisions when structuring deals. Beyond operational benefits, AI also supports enhanced customer relationship management by personalizing service offerings and predicting client needs. While the full scope of AI's impact is still unfolding, its role in creating a more agile, cost-effective, and data-driven ACMI leasing ecosystem is becoming increasingly evident, promising a future of optimized fleet management and more resilient aviation operations.

- Predictive Maintenance Optimization: AI algorithms analyze sensor data to forecast component failures, reducing unscheduled downtime and improving aircraft availability.

- Dynamic Pricing Models: AI enables lessors to adjust lease rates in real-time based on market demand, seasonality, and aircraft availability, maximizing revenue.

- Operational Efficiency Enhancement: AI optimizes flight routes, fuel consumption, and crew scheduling, leading to significant cost savings for lessees.

- Risk Assessment and Mitigation: AI identifies potential financial or operational risks in lease agreements, aiding in more informed decision-making for lessors.

- Automated Contract Management: AI streamlines lease agreement processes, from drafting to compliance monitoring, increasing efficiency and accuracy.

Key Takeaways Aircraft ACMI Leasing Market Size & Forecast

Common user questions about key takeaways from the Aircraft ACMI Leasing market size and forecast often focus on the most impactful insights for stakeholders, future growth drivers, and potential shifts in market dynamics. Users want to know where the most significant opportunities lie, what challenges might impede growth, and how the market's trajectory will influence airline strategies and investment decisions. There is also interest in understanding the long-term viability of ACMI models in various economic scenarios and the regions poised for the most substantial expansion.

The Aircraft ACMI Leasing market is poised for sustained and robust growth through 2033, driven by the aviation industry's imperative for flexibility and capital efficiency. This growth signifies a fundamental shift in how airlines manage their fleets, increasingly relying on ACMI models to scale operations, manage peak seasons, and expand into new routes without the burden of significant upfront investments. The forecast underscores the resilience of the aviation sector and its adaptive capacity, with ACMI leasing serving as a critical enabler for strategic expansion and operational optimization. The market’s trajectory indicates that ACMI solutions will remain a cornerstone of airline strategy, facilitating agile responses to evolving market demands.

Furthermore, the market's expansion is not merely quantitative but also reflects a qualitative evolution, with a rising demand for newer, more fuel-efficient aircraft that align with global sustainability objectives. This trend suggests that lessors investing in modern fleets will gain a competitive advantage. The increasing complexity of global air travel networks and the continued emergence of new airlines, particularly in developing regions, will further solidify the market's growth. The key takeaway is the strategic importance of ACMI leasing as a core business model that offers an essential balance of cost control, operational agility, and environmental responsibility for airlines navigating a dynamic and challenging global landscape.

- Sustained Market Expansion: The market is projected for significant growth, highlighting the long-term strategic value of ACMI leasing for airlines.

- Operational Flexibility as a Core Driver: Airlines will increasingly leverage ACMI to manage demand fluctuations, seasonal peaks, and network expansion efficiently.

- Shift Towards Modern Fleets: Growing preference for newer, more fuel-efficient, and environmentally compliant aircraft will shape lessor investment strategies.

- Emerging Markets as Growth Hubs: Developing regions are expected to be key drivers of new demand, fueled by increasing air travel penetration and new airline entrants.

- Resilience of Aviation Sector: The market's robust forecast reflects the aviation industry's ability to adapt and recover from external shocks, with ACMI as a key enabler.

Aircraft ACMI Leasing Market Drivers Analysis

The Aircraft ACMI Leasing market is significantly influenced by a confluence of factors that collectively propel its growth. A primary driver is the inherent flexibility and capital efficiency that ACMI agreements offer to airlines. In a highly capital-intensive industry, leasing provides an alternative to outright aircraft acquisition, allowing carriers to preserve capital, manage liquidity, and rapidly adjust their fleet size in response to market demand or unexpected operational needs. This agility is particularly crucial for seasonal operations, new route launches, or bridging gaps during maintenance events, enabling airlines to optimize their fleet utilization without long-term commitments.

Another compelling driver is the resurgence and continued growth in global air travel, both for passenger and cargo segments. Post-pandemic recovery has seen a rapid increase in demand, often outpacing the available fleet supply or the ability of airlines to quickly expand their owned fleets. ACMI leasing serves as an immediate solution to augment capacity, especially for peak seasons or specialized cargo requirements. Furthermore, the entry of new airlines, particularly low-cost carriers in emerging markets, frequently leverages ACMI as a cost-effective way to commence operations without the substantial upfront investment in aircraft, crew, and associated infrastructure. This dynamic expansion of the airline landscape fuels consistent demand for leased assets.

| Drivers | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Increased Global Air Travel Demand | +2.5% | Global, particularly Asia Pacific, North America, Europe | Short to Medium-term (2025-2030) |

| Airline Operational Flexibility & Capital Preservation | +2.0% | Global, especially for LCCs and startup airlines | Long-term (2025-2033) |

| Fleet Modernization & Fuel Efficiency Needs | +1.5% | Europe, North America, environmentally conscious airlines | Medium to Long-term (2027-2033) |

| Growth of Air Cargo Operations | +1.2% | Global, key logistics hubs (e.g., China, USA, Germany) | Short to Medium-term (2025-2030) |

| Seasonal & Peak Season Demand Management | +1.0% | Europe (summer), North America (holidays), tourism-reliant regions | Recurring annually |

Aircraft ACMI Leasing Market Restraints Analysis

Despite its significant growth potential, the Aircraft ACMI Leasing market faces several formidable restraints that could temper its expansion. One of the most critical is the volatile nature of fuel prices, which directly impacts the operational costs of ACMI agreements. Since lessors typically bear the fuel costs in an ACMI arrangement, significant fluctuations can erode profit margins and introduce considerable financial risk. This volatility can lead to higher lease rates, potentially deterring lessees who might then seek alternative arrangements or reduce their capacity, especially when combined with other rising operational expenses such as insurance premiums and maintenance costs.

Another significant restraint involves stringent regulatory requirements and geopolitical instability. The aviation industry is heavily regulated, with varying airworthiness directives, crew licensing standards, and operational permits across different jurisdictions. Navigating these complex and often divergent regulatory frameworks can be time-consuming and costly for lessors operating globally. Furthermore, geopolitical tensions, trade disputes, and regional conflicts can lead to airspace restrictions, sanctions, and reduced demand for air travel, directly impacting the deployment and profitability of leased aircraft. Such external factors introduce an unpredictable element into long-term planning and investment decisions within the ACMI market, making it challenging for both lessors and lessees to commit to stable, multi-year contracts.

| Restraints | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Volatile Fuel Prices | -1.8% | Global, particularly for long-haul operations | Ongoing, variable impact |

| Stringent Regulatory Compliance | -1.5% | Global, varying by region (e.g., EU, FAA, EASA) | Long-term (2025-2033) |

| Geopolitical Instability & Conflicts | -1.2% | Affected regions (e.g., Eastern Europe, Middle East) | Short to Medium-term (Localized) |

| Global Economic Slowdown & Inflation | -1.0% | Global, affecting discretionary travel | Short to Medium-term (2025-2027) |

| Shortage of Skilled Aviation Personnel (e.g., Pilots) | -0.8% | North America, Europe, parts of Asia | Long-term (2028-2033) |

Aircraft ACMI Leasing Market Opportunities Analysis

The Aircraft ACMI Leasing market presents significant opportunities for growth, particularly driven by the expanding air cargo sector. With the boom in e-commerce and global supply chain demands, airlines are increasingly converting passenger aircraft for cargo use or acquiring dedicated freighters. ACMI agreements offer a quick and flexible solution for carriers to scale their cargo operations without extensive capital investment, enabling them to meet fluctuating shipping demands and capitalize on lucrative freight routes. This shift towards cargo-centric operations, coupled with the ongoing need for efficient logistics, opens new revenue streams for lessors specializing in cargo aircraft or conversion capabilities.

Furthermore, the demand from emerging markets and the increasing number of new airline entrants create substantial opportunities. As economies in Asia Pacific, Latin America, and Africa grow, so does the demand for air travel, often leading to the establishment of new airlines or the expansion of existing ones. These new or rapidly growing carriers frequently prefer ACMI leases to build their initial fleet or test new routes, as it mitigates financial risk and offers immediate operational capabilities. Additionally, the increasing focus on sustainable aviation and the development of eco-friendly technologies present opportunities for lessors to invest in green aircraft or offer leasing models that incorporate carbon offsetting or efficiency incentives, appealing to environmentally conscious airlines and regulators. Integrating value-added services such as MRO (Maintenance, Repair, and Overhaul) and crew training directly into ACMI contracts also enhances the overall value proposition, creating a more comprehensive and attractive offering for lessees.

| Opportunities | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Expansion of Air Cargo Market | +1.9% | Global, particularly Asia Pacific and North America | Medium to Long-term (2026-2033) |

| Growth in Emerging Markets & New Airline Entrants | +1.7% | Asia Pacific, Latin America, Africa | Long-term (2027-2033) |

| Increasing Demand for Specialized Aircraft (e.g., Charters) | +1.3% | Tourism-driven regions, corporate travel hubs | Short to Medium-term (2025-2030) |

| Integration of Value-Added Services (MRO, Training) | +1.0% | Global, particularly for long-term contracts | Long-term (2028-2033) |

| Development of Sustainable Aviation Initiatives | +0.8% | Europe, North America, progressive airlines | Medium to Long-term (2027-2033) |

Aircraft ACMI Leasing Market Challenges Impact Analysis

The Aircraft ACMI Leasing market is continually navigating a landscape of complex challenges that can significantly impact its operational dynamics and profitability. One major challenge is the intense competition among lessors, which can drive down lease rates and narrow profit margins. This competitive pressure is exacerbated by the cyclical nature of the aviation industry, where periods of high demand can quickly be followed by downturns, leaving lessors with idle fleets and the burden of substantial asset ownership costs. Managing these cycles effectively requires sophisticated risk assessment and fleet deployment strategies to minimize revenue loss during periods of reduced demand or oversupply.

Another critical challenge stems from global supply chain disruptions and the inherent volatility of the economic environment. The availability of spare parts for aircraft maintenance, lead times for new aircraft deliveries, and access to skilled labor can be severely impacted by geopolitical events, trade wars, or public health crises. These disruptions can lead to extended maintenance downtimes, delayed aircraft handovers, and increased operational costs, all of which directly affect the profitability and reliability of ACMI agreements. Furthermore, economic uncertainties such as inflation, interest rate hikes, and currency fluctuations can impact both the lessor's financing costs and the lessee's ability to meet payment obligations, introducing significant financial risk for all parties involved in an ACMI transaction. Navigating these macro-economic shifts requires robust financial planning and adaptable contract structures.

| Challenges | (~) Impact on CAGR % Forecast | Regional/Country Relevance | Impact Time Period |

|---|---|---|---|

| Intense Market Competition & Margin Pressure | -1.6% | Global, particularly mature markets | Ongoing, pervasive |

| Global Supply Chain Disruptions & Part Shortages | -1.4% | Global, impacting maintenance and delivery | Short to Medium-term (2025-2028) |

| Economic Downturns & Reduced Air Travel | -1.1% | Global, with varying regional severity | Short-term (cyclical) |

| Cybersecurity Threats & Data Breaches | -0.9% | Global, affecting operational integrity | Ongoing, increasing risk |

| Managing Idle Fleet & Asset Depreciation | -0.7% | Global, impacting lessor profitability | Long-term, strategic |

Aircraft ACMI Leasing Market - Updated Report Scope

This comprehensive market research report provides an in-depth analysis of the Aircraft ACMI Leasing market, encompassing its historical performance, current dynamics, and future projections. The scope includes a detailed examination of market size, growth drivers, key restraints, emerging opportunities, and critical challenges impacting the industry. The report also features an extensive segmentation analysis, covering various aircraft types, lease durations, applications, and regional market insights. Furthermore, it presents a competitive landscape overview, profiling key players and their strategic initiatives, alongside an impact analysis of artificial intelligence on market evolution. The objective is to offer actionable intelligence for stakeholders to make informed business decisions within this dynamic sector.

| Report Attributes | Report Details |

|---|---|

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2033 |

| Market Size in 2025 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Growth Rate | 8.2% |

| Number of Pages | 247 |

| Key Trends |

|

| Segments Covered |

|

| Key Companies Covered | Global Air Lease Solutions, AeroFleet Management Inc., SkyConnect Leasing Corp., Horizon Aviation Leasing, Ascent Aircraft Services, Omni Air International, Atlas Air Worldwide, Air Transport Services Group (ATSG), Cargolux Airlines International, Maersk Air Cargo, SmartLynx Airlines, Hi Fly, Wamos Air, Maleth-Aero, Air Atlanta Icelandic, European Air Transport Leipzig, VistaJet, NetJets, Flexjet, Jet Aviation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Speak to Analyst | Avail customised purchase options to meet your exact research needs. Request For Analyst Or Customization |

Segmentation Analysis

The Aircraft ACMI Leasing market is intricately segmented to provide a granular understanding of its diverse components and drivers. These segmentations allow for a detailed analysis of market dynamics across different aircraft types, operational models, and end-user applications. Understanding these specific segments is crucial for identifying targeted growth opportunities and developing tailored strategies for both lessors and lessees, ensuring that services align with evolving industry needs and market demands. The market's structure reflects the specialized requirements of various aviation sectors, from high-capacity passenger transport to specialized cargo logistics and niche charter operations.

- Aircraft Type: This segment differentiates the market based on the categories of aircraft leased.

- Narrow-body Aircraft: Dominant for short to medium-haul passenger routes due to fuel efficiency and versatility.

- Wide-body Aircraft: Primarily used for long-haul international passenger and heavy cargo operations.

- Regional Jets: Essential for connecting smaller cities and regional hubs, providing critical connectivity.

- Turboprops: Valued for short-haul flights, especially in challenging terrain or for regional feeder services.

- Lease Type: This segment categorizes leases based on the scope of services provided by the lessor.

- Wet Lease: Includes Aircraft, Crew, Maintenance, and Insurance (ACMI), offering a complete operational solution.

- Damp Lease: Typically includes Aircraft, Maintenance, and Insurance, with the lessee providing the crew.

- Dry Lease: Involves only the aircraft, with the lessee responsible for all other operational aspects.

- Application: This segment explores the primary use case of the leased aircraft.

- Passenger Operations: Leasing for scheduled passenger flights, charter, and seasonal capacity needs.

- Cargo Operations: Leasing dedicated freighters or converted passenger aircraft for freight transport.

- Special Missions: Includes leasing for specific purposes such as medical transport, aerial surveying, or executive charters.

- End-Use: This segment identifies the type of entity utilizing the ACMI leasing services.

- Commercial Airlines: Major flag carriers, low-cost carriers, and regional airlines leveraging ACMI for fleet management.

- Charter Operators: Companies providing on-demand air services for leisure, corporate, or specialized groups.

- Freight Companies: Logistics and express parcel companies utilizing ACMI for dedicated air cargo networks.

- Government & Military: Agencies or defense contractors requiring specialized air support or transport.

Regional Highlights

- North America: This region is a mature and highly developed market for Aircraft ACMI Leasing, characterized by a large number of established airlines and a robust demand for both passenger and cargo operations. The market here benefits from strong economic growth, high air travel penetration, and significant investment in fleet modernization. Operational flexibility for seasonal peaks and the expansion of cargo networks are key drivers, with major lessors and airlines actively engaged in long-term and short-term ACMI agreements.

- Europe: Europe represents a significant market for ACMI leasing, driven by the presence of numerous national carriers, low-cost airlines, and a highly competitive aviation landscape. The region sees substantial ACMI activity for managing peak summer travel seasons, launching new routes, and adapting to fluctuating geopolitical conditions. Regulatory frameworks from EASA also play a crucial role in shaping leasing agreements, with a growing emphasis on environmental compliance and the adoption of more fuel-efficient aircraft.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the Aircraft ACMI Leasing market, propelled by rapidly expanding economies, increasing disposable incomes, and a burgeoning middle class driving unprecedented demand for air travel. The emergence of new airlines, particularly low-cost carriers, and the significant growth in air cargo volumes, especially from e-commerce, are key factors fueling the adoption of ACMI solutions across countries like China, India, and Southeast Asia.

- Latin America: The Latin American market for ACMI leasing is experiencing steady growth, influenced by regional economic development and an increasing need for domestic and international air connectivity. Airlines in this region often use ACMI to manage capacity during peak travel seasons, overcome fleet limitations, or test new routes with reduced financial risk. The market is also seeing a rise in demand for cargo services to support growing trade volumes.

- Middle East and Africa (MEA): The MEA region offers considerable opportunities, driven by strategic geographic positioning, significant investments in aviation infrastructure, and the expansion of major hub airlines. ACMI leasing is vital for these carriers to manage their vast networks, particularly for long-haul routes and during periods of strong inbound and outbound tourism. In Africa, ACMI supports the growth of emerging airlines seeking flexible and cost-effective operational solutions to improve regional connectivity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft ACMI Leasing Market.- Global Air Lease Solutions

- AeroFleet Management Inc.

- SkyConnect Leasing Corp.

- Horizon Aviation Leasing

- Ascent Aircraft Services

- Omni Air International

- Atlas Air Worldwide

- Air Transport Services Group (ATSG)

- Cargolux Airlines International

- Maersk Air Cargo

- SmartLynx Airlines

- Hi Fly

- Wamos Air

- Maleth-Aero

- Air Atlanta Icelandic

- European Air Transport Leipzig

- VistaJet

- NetJets

- Flexjet

- Jet Aviation

Frequently Asked Questions

What is Aircraft ACMI Leasing?

Aircraft ACMI (Aircraft, Crew, Maintenance, and Insurance) Leasing is an agreement where one airline (the lessor) provides an aircraft, complete with flight crew, maintenance services, and insurance coverage, to another airline (the lessee) for a specified period. This comprehensive leasing model allows the lessee to operate flights without the capital expenditure and operational complexities of owning the aircraft or managing the full operational infrastructure. It is often utilized for seasonal capacity adjustments, new route launches, or covering maintenance downtime.

Why do airlines opt for ACMI leases?

Airlines choose ACMI leases primarily for operational flexibility and capital efficiency. It enables them to rapidly adjust fleet capacity to meet fluctuating demand, manage seasonal peaks, or quickly launch new routes without substantial upfront investment. This model minimizes financial risk, avoids the lengthy process of aircraft acquisition, and offloads the burdens of crew management, maintenance, and insurance to the lessor, allowing the lessee to focus on sales, marketing, and passenger services.

What are the primary benefits of ACMI leasing?

The primary benefits of ACMI leasing include enhanced operational flexibility, allowing airlines to quickly scale up or down based on demand; significant capital preservation by avoiding direct aircraft purchase; reduced operational burden, as maintenance, crew, and insurance are handled by the lessor; and immediate access to specific aircraft types or capacities. It also provides a strategic advantage for testing new markets or maintaining continuity during fleet transitions or unexpected maintenance events, ensuring minimal disruption to flight schedules.

What challenges exist in the ACMI leasing market?

Key challenges in the ACMI leasing market include volatile fuel prices, which impact profitability for lessors; stringent and often varying international regulatory compliance requirements; and intense market competition that can compress profit margins. Geopolitical instability and global economic downturns can also reduce demand for air travel, leading to idle fleets and financial strain for lessors. Additionally, supply chain disruptions affecting spare parts and skilled labor shortages pose ongoing operational challenges.

How is the Aircraft ACMI Leasing market expected to grow by 2033?

The Aircraft ACMI Leasing market is projected for robust growth, reaching USD 20.0 Billion by 2033 from USD 10.5 Billion in 2025, demonstrating a CAGR of 8.2%. This growth is driven by the post-pandemic resurgence in air travel, the increasing need for operational flexibility among airlines, the expansion of air cargo operations, and the emergence of new airlines in developing regions. A growing emphasis on fleet modernization and the adoption of more fuel-efficient aircraft also contribute significantly to this positive market trajectory.